What is Crypto?

A cryptocurrency is a virtual or digital currency and is nearly impossible to double-spend or counterfeit as it is secured by cryptography.

Most of cryptocurrencies are decentralized networks that are based on blockchain technology.

One of the main features of cryptocurrencies is that it is not issued by any central authority i.e. they are theoretically immune to manipulation or government interference.

- A digital asset form that is based on a network and distributed across several computers are known as cryptocurrency. Cryptocurrencies exist outside the control of central authorities and governments due to the decentralized structure.

- ‘Cryptocurrency’ – The word is derived from the techniques of encryption that are used for securing the network.

- Blockchain is an integral part of many cryptocurrencies and is an organizational method to ensure the integrity of transactional information and data.

- Few experts believe that technology such as blockchain will disrupt industries such as law and finance.

- Cryptocurrencies aren’t immune from criticism. The vulnerabilities of the system underlying cryptocurrencies, exchange rate volatility and their use in illegal activities are the few significant reasons for their criticism. On the other hand, cryptocurrencies have been lauded for their transparency, inflation resistance, divisibility, and portability.

Cryptocurrencies allow for online secure payments that are denominated in terms of ‘tokens’ which are virtual.

These are represented by entries that are internal to the system.

‘Crypto’ refers to the several cryptographic techniques and encryption algorithms that safeguard such entries, like hashing functions, public-private key pairs, and elliptical curve encryption.

Ethereum Blockchain App Using Ganache And Web3.Js

Key Crypto Altcoins

Bitcoin has become the de facto the standard for cryptocurrencies and it is inspiring and motivating an ever-growing and whole legion of spinoffs and followers.

The currencies that are modelled after BTC are collectively known as ‘altcoins’.

In some cases, they are also known as ‘shitcoins’.

Altcoins have many a time tried to pose themselves as improved or modified versions of Bitcoin.

While few of such currencies might have some features that Bitcoin does not, matching the same level of security that networks of Bitcoins achieve has largely yet to be seen by an altcoin.

Below, we will be discussing some of the major digital cryptocurrencies other than Bitcoin.

Do you know that as of January 2021, there are over 4000 cryptocurrencies in existence?

Many of such cryptocurrencies have little to 0 trading volume or following, some of these cryptocurrencies are immensely popular among dedicated communities of investors and backers.

Also, the cryptocurrency field is ever-growing and the next big digital cryptocurrency may get released tomorrow.

Bitcoin is a pioneer in the cryptocurrency world, however, analysts adopt several approaches to evaluate tokens other than Bitcoin.

- Ethereum (ETH)

- Litecoin (LTC)

- Cardano (ADA)

- Polkadot (DOT)

- Bitcoin Cash (BCH)

- Stellar (XLM)

- Chainlink

- Binance Coin (BNB)

- Tether (USDT)

- Monero (XMR)

Benefits of investing in Crypto

1 Security

Bitcoin transactions is a revolutionary method that blazed the cryptocurrency and digital world with the new technique of mining and blockchain.

The transactions that involve bitcoins are stored transparently in a distributed public ledger.

Such blockchain is visible to all the users, whether they are participating or non-participating.

These types of blockchain are maintained by miners. They can create a new blockchain by solving very complex problems which require considerable computing.

Let’s say if any hacker wants to corrupt the entire process then he/she needs to take control of more than 51 per cent of the complete blockchain network, which is fruitless and redundant. Therefore, because of its ingenious design, crypto is significantly secure.

2 No 3rd – party

Crypto works on peer-to-peer networks that are free from 3rd-party overseers as seen in traditional modes of digital transactions.

Therefore, the high transaction fee is cut short as now business can be performed directly without paying a middleman over the world wide web.

No 3rd-party benefit also contributes to additional security as you aren’t taking the aid of an untrustworthy middleman now, which was eventually affecting your transactions.

3 Less competition

There is less competition in the cryptocurrency market as compared to other modes of digital transactions with Bitcoin being the pioneer in the field.

Ethereum is using the same blockchain technology as Bitcoin but hasn’t reached the wide ranges of the latter yet.

4 Popular Investment Option

Due to its rising valuation and exchange rate, most of the investors have realized the potential of investing in cryptocurrencies.

While some of the investors are still cautious about the fluctuating rates and values of cryptocurrencies, it goes without saying that crypto is the next big thing in the investing world.

All thanks to the low transaction fee and high-security level, crypto has already become a viable alternative to traditional commodities such as real estate and gold.

I agree that the risk is marginally higher, but it can be justified due to the experimental nature of the cryptocurrency and is comfortably offset by its high return on investment (ROI).

5 Easy application

The development and mining of blockchain might require sophisticated tools and heavy and high computing power, but the users engaging in investment and transactions can easily do so with the help of easy-to-use software and applications.

Major cryptocurrencies are compatible with all famous devices such as desktops and smartphones.

A transaction can be easily carried out with the help of a wallet along with 2 sets of unique keys that must be securely and carefully stored offline.

6 Inflation Resistant

One of the very visible and significant advantages of investing in a cryptocurrency is that it is not like the traditional form of money.

Its limited nature doesn’t allow it to be plagued by inflation issues which have destroyed many major offline financial markets in the past by creating bubbles.

Therefore, the volatile cost of crypto can be compensated by its inflation resistance.

7 Wide acceptance

Crypto is slowly and steadily becoming the new normal and form of transaction.

Most of the organizations are accepting it as a legitimate currency form instead of credit and cash.

Unlike fiat currency, a 0 transaction fee is imposed in the trading of crypto across borders.

This poses another advantage in favor of crypto investment as this pool is widened across the global market.

Crypto are slowly and steadily gaining recognition as a strong player in the investment spaces and financial fields.

Most of the investors are racing for investing in crypto due to inflation-resistance, wide acceptability, transparent transactions, and great security.

The time may come soon when virtual investments will dominate the financial landscape.

Limitations of Cryptocurrency

1 Scalability

The biggest concern with cryptocurrency are the issues with scaling that are posed.

While the adoption and number of digital coins is increasing rapidly, it is still limited by the number of transactions that payment giants such as visa or MasterCard processes each day.

The speed of a transaction is also an other vital metric that cryptocurrencies can not complete with on the same level as players such as MasterCard and Visa until the infrastructure delivering these technologies is massively scaled.

Set an evolution is difficult and complex to do seamlessly.

However some have already proposed various solutions such as staking, sharding and lightning networks as options for overcoming the scalability problem.

2 Cybersecurity Issues

Cryptocurrencies may fall into the hands of hackers and will be subject to cyber security breaches as a digital technology.

Reducing this will require a continuous upkeep of the infrastructure of the security.

However, we are already seeing various players dealing with this and using advanced cyber security measures that go beyond those used in the old and traditional back in industries.

3 Lack of Inherent Value and Volatility of Prices

Volatility of price, tied to a lack in inherent value, is a major issue and one of the specific that Warren Buffett referred to when he categorised the cryptocurrency ecosystemas a bubble.

It is a crucial concern, however, one which can be overcome by linking the value of the cryptocurrency directly to intangible and tangible assets.

Increased adoption should also decrease this volatility and increase consumer confidence.

4 Regulations

Even if we perfect this technology and get rid of all the issues that are listed above, until this technology is regulated and adopted by the Federal government, there will be a high risk in investing in this technology.

Other concerns with this technology are mostly logistical in nature such as changing protocols that becomes necessary when the technology is being improved can interrupt the normal flow of operations and take quite a long time.

What is Bitcoins?

A digital and virtual currency that was created in January of 2009 was Bitcoin.

Bitcoin follows the ideas that were set out in a whitepaper by the pseudonymous and mysterious Santoshi Nakamoto.

Do you know that the identity of the people who created Bitcoin is still unknown?

Bitcoin is operated by a decentralized authority and it also offers the promise of a low transaction fee as compared to other traditional modes of online payment.

A type of crypto, Bitcoin balances are stored on a public ledger and everyone (whether participating or non-participating) has transparent access to it.

A huge amount of computing power verifies all the transactions of Bitcoin.

These are neither backed nor issued by any governments or banks, nor are individual bitcoin valued as a commodity.

This immensely popular cryptocurrency is abbreviated as ‘BTC’ and has triggered the launch of many other cryptocurrencies as well.

- Going by market capitalization, Bitcoin is the globe’s biggest cryptocurrency which was launched in 2009.

- Bitcoin is stored, traded, distributed, and created through a decentralized ledger system. This system is called the blockchain.

- As per value, the history of BTC has been turbulent. It skyrocketed up to the US $20000 per coin in 2017 but was trading for less than 50 per cent of it less than a year later.

- Bitcoin is the earliest digital and virtual currency to meet widespread success and immense popularity. It has also inspired and motivated plenty of other cryptocurrencies in its wake.

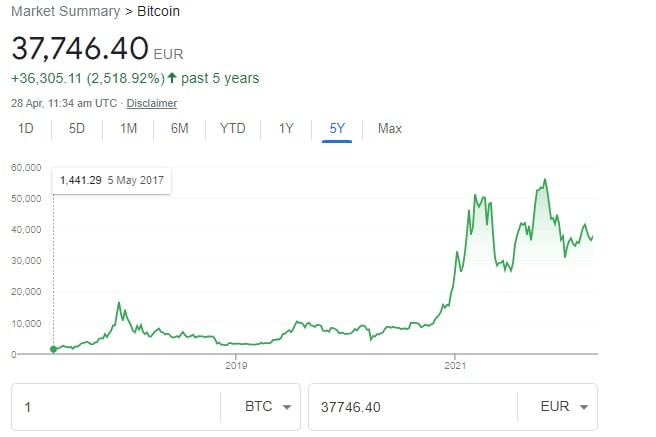

Bitcoin Growth

Investors of Bitcoins have mostly had a bumpy ride in the past 10 years.

Keeping aside the daily inclines and declines of its value, investors have had to contend with several issues plaguing its ecosystem.

Despite all this, there were periods when Bitcoin’s value changes even outpaced the usual volatile swings, which resulted in big price bubbles.

The 1st such occurrence was in 2011. The price of Bitcoin jumped from US $1 in April to US $32 in June i.e. a gain of 3200 per cent in 3 months.

This was followed by a sharp recession in crypto markets and the price of Bitcoin bottomed out at US $2 in November that year.

2013 was a decisive year in the price of Bitcoin as the trading started at US $13.40 that year and underwent 2 price bubbles in that same year.

Bitcoin’s price shot up to US $220 by April 2013.

This rapid increase was followed by an equally swift deceleration in its value and Bitcoin was exchanging hands at US $70 in mid-April.

But, that wasn’t the end as Bitcoin was trading at US $123.20 in early October that year.

It spiked to US $1156.10 by December. These rapid changes were proof of a multi-year slump in the price of Bitcoin and it touched US $315 at the beginning of 2015.

The 5th price bubble occurred in 2017 as Bitcoin was hovering around the US $1000 mark at the beginning of that year.

Bitcoin’s price charted a remarkable ascent of $20089 on 17th December that year.

The hot streak of 2017 also aided in placing this cryptocurrency firmly in the mainstream spotlight.

Economists and Governments began taking notice and developing cryptocurrencies to compete with BTC.

Investors and so-called experts made several values and price forecasts and analysts debated its value as an asset.

There was a resurgence in trading volume and price in June 2019 as its value surpassed the US $10000, and hopes of another rally were demolished as Bitcoin’s price fell to the US $7112.73 by December.

It was not until the 2020 pandemic that the value and price of Bitcoin boosted into activity once again.

Bitcoin’s rise was accelerated by the COVID-19 pandemic lockdown and the subsequent government policies.

The cryptocurrency was trading at close to the US $18353 on 23rd November.

The COVID-19 crisis crushed the stock market in March 2020, however, the subsequent stimulus checks of up to the US $1200 might have had a direct influence on the markets.

Bitcoin witnessed a massive rebound from March 2020 lows and even surpassed its previous all-time highs.

Such checks amplified concerns over potentially weakened purchasing power of the US dollar and inflation.

Money printing by Central banks and Governments helped to bolster the Bitcoin narrative as a store of value as its supply is capped at twenty-one million.

Bitcoin surpassed its previous all-time high in January 2021 by crossing the US $40000 mark. As of 8th January 2021, Bitcoin was changing hands at US $41528.

However, it was trading at US $30525.39 on 11th January 2021.

Global Acceptance

Crypto has become a global phenomenon, and it can be said that it seems confusing to many.

The most widely recognized and immensely popular crypto is Bitcoin, which has crossed a transactional volume of 2000 per day.

Big corporations such as Dish, Dell, and Microsoft are acceptable forms of crypto as payment.

What started as a peer-to-peer money transfer, has now become a part of industries and businesses such as the technology industry.

Few companies are even starting to mine Bitcoin in an environmentally-friendly manner.

The Moonlight Project aims to use sustainable and clean energy sources for creating Ethereum and Bitcoin.

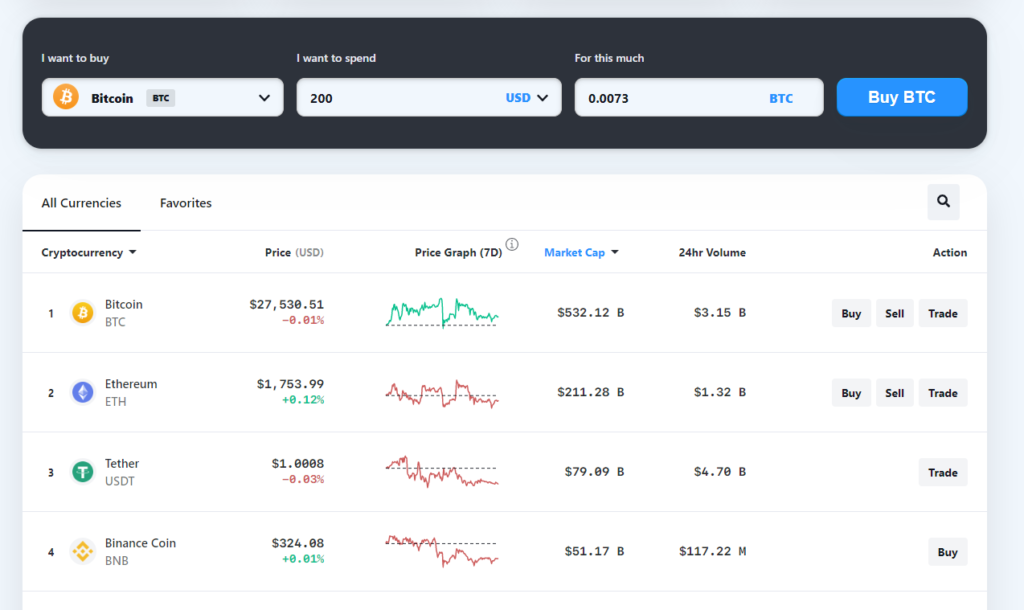

How to buy cryptocurrency?

Step 1 : Select an exchange

Shining off for a cryptocurrency exchange will let you hold sell and buy cryptocurrency.

It is typically a best practice for using exchange which allows its users for withdrawing their cryptocurrency to their own personal wallet for safer keeping.

There are several brokerage and exchanges platforms which do not allow this.

This feature may not matter for those looking to consistently trading Bitcoin or any other cryptocurrency.

Some exchanges allows its users to not require them to enter personal information and allow users to remain anonymous, get the ethos of Bitcoin being individual sovereignty and decentralization.

The exchanges which allow this are generally decentralized and operate autonomously which means there is 0 central point of control.

If I put this in other words, then there is no group or no person or no CEO for any regulatory body for pursuing should it have concerns over illegal activity taking place.

These exchanges also provide services to the unbanked world while they do not have the potential to be used for nefarious activities.

Individuals like this may include refugees of those living in nations where there is zero banking infrastructure of government for providing a state identification which is required for an investment or a bank account.

Some people believe that the good in the services outweigh the potential for illegal activities as unbanned individuals now can you set to climb out of poverty and have a way of storing wealth.

The most commonly used exchanges types do require KYC and are not decentralized right now.

To name a few, these exchanges include Binance, Gemini, Kraken, and Coinbase in the United States of America.

These exchanges have grown in a big way in the no of features they provide. Gemini, Kraken, and Coinbase provide Bitcoin and an increasingly number of altcoins.

These 3 are the easiest on-ramp to cryptocurrency in the complete industry and Binance offer numerous altcoins to choose from, offering more serious trade functionality and caters to a more advanced trader.

A vital thing to note here is when developing an exchange account of cryptocurrency is for using safer internet practices.

This includes using a password which is long and unique, including a variety of numbers, special characters, capitalized letters, and lowercase letters; and a 2-factor authentication.

Step 2 : Connecting your exchange to an option of payment

You now need to gather your personal documents, once you have chosen an exchange.

These may include sources of funds, info about your employer, as well as social security number, pictures of the license of a driver, depending on the exchange.

The data you may require can depend on the area you stay in and the laws within it. The process is mostly the same as setting up an account of a typical brokerage.

You may connect a payment option after the exchange has ensured your legitimacy and identity.

You can connect a debit or credit card or you can connect your bank account directly with the exchanges listed above.

It is typically something that should be avoided due to the volatility that cryptocurrencies can experience, while you can use a credit card to buy cryptocurrency.

Some banks do not take too kindly to the idea and may stop or even question deposits to cryptocurrency related exchanges or sites, while Bitcoin is legal in the United States of America.

It is a good idea to check to ensure that your bank allows deposits at your selected exchange, while most banks do allow these deposits.

There are varying deposits fees via a credit card, debit card, or a bank account. For instance, Coinbase is a solid exchange for beginners that has a 3.99 per cent fee for credit and debit cards, and has a 1.49 per cent fee for bank accounts.

It is crucial for researching the fees associated with each payment method to help select which payment option works best for you or to select an exchange.

Step 3 : Place an order

You can now buy cryptocurrencies such as Bitcoin, once you have connected a payment option and chosen an exchange. Over the years, exchanges have grown significantly in terms of their breadth of features and liquidity.

It has grown to be considered legitimate and trustworthy.

Now, exchanges of cryptocurrency have gotten to a point where they have the same features level as their brokerage of stocks counterparts.

You are ready to go, once you have connected to a payment method and have found an exchange.

Exchanges also provide ways for setting up recurring investments allowing clients to dollar cost average into their choice of investments, aside from a wide range of types of orders.

For instance, Coinbase, allows users set recurring purchases for every month, week, or even day.

There are some other steps to consider for more security and safety, however, getting an account on an exchange is all you need to do for buying cryptocurrencies such as Bitcoin.

Step 4: Safe Storage

Cryptocurrency wallets and Bitcoin are a place for storing digital assets more securely.

Having your cryptocurrency in your personal wallet and outside of the exchange ensures that only you have control over the private key to your funds.

It also avoids the risk of you losing your funds and your exchange getting hacked, and provides you the ability for storing funds away from an exchange.

Some wallets offer more features as compared to others, as some provide the ability for storing numerous kinds of altcoins, while others are Bitcoin only.

You have a number of options when it comes to selecting a Bitcoin wallet. The 1st thing that you will need to understand is the concept of cold wallets (hardware or paper wallets) and hot wallets (online wallets).

Hot Wallets

Hot Wallets are online wallets that run on Internet-enabled devices such as tablets, phones, or computers. Storing your private keys on internet-enabled devices makes it more susceptible to a hack, while a hot wallet can be very convenient for making and accessing transactions with your assets quickly.

These wallets are best used for cryptocurrency or a small amount of cryptocurrency that you are actively trading on an exchange.

A person who has conventional financial wisdom will say to hold only spending cash in a checking account while the bulk of his or her money is in other investments account such as a savings account.

The same could be said for hot wallets as hot wallet and encompasses exchange, web and desktop account custody wallets.

Cold Wallets

Cold Wallets aren’t connected to the Internet and stands at a far lesser risk of being compromised, and these wallets can also be referred to as hardware wallets or offline wallets.

These wallets store a private key of a user on something that is not connected to the world wide web and can come the software which works in parallel so that the users can view their portfolio without putting their personal key at risk.

How to research Cryptocurrency?

Method one: Exploring the platforms of Social Media

Social media platforms should be taken very seriously as if platform provides specific insights and it should see an increase in price when a coin is heavily shilled.

Method two: Analyzing events that are upcoming

You will need to get a global view point, as with everything, social media as a small piece of the puzzle.

In this case, if you are able to identify how similar events worked in the past then upcoming events can be a great information point.

You can do a search for any kind of coin that you are interested in and write down the dates of the event itself as this will help you to make better short-term predictions.

Method three : Research the fundamentals

You need to understand that creating a smarter smart contract will not automatically make a coin more valuable as compared to Ethereum and allowing more transactions per block will not make a coin better than Bitcoin.

Method four : Discover trending topics

Checking trending events and coins should be on the top of your list when looking at how to research cryptocurrency.

The best way for analysing the market sentiment is to get a good overview of the number of individuals who are searching for a specific topic

Method five : Use the power of the niche forums

First of all you need to get more in-depth information about the coin you are exploring and its upcoming events.

Secondly you can talk with people who are more experience as compared to you by starting new topics on your point of interest.

Method six : Go to crypto meetups

People are extremely enthusiastic in the Crypto meetups.

You candiscover more technical details which can help you craft the research strategy.

Method seven : Observe transaction volume

If you look at the transaction volume of a coin over time, then you can make a more in depth observation point.

Applying the above-mentioned research strategy can act as a great beginning for leading to more profits and hopefully better investment decisions.

How does Cryptocurrency works?

Cryptocurrencies use decentralized technology for letting its users store money and makes secure payment without requiring their name or go through a bank.

They run on a distributed public ledger known as blockchain which is held by currency holders and record of all transactions updated.

Cryptocurrency units are developed and created through a process known as mining, which will be discussing in the next segment thoroughly.

This involves using computational power for solving complicated mathematics problems for generating coins.

A user can also purchase the currencies from brokers then spend and store them using wallets of cryptocurrency known as cryptographic wallets.

More users should be expected in applications of blockchain Technology and cryptocurrencies as these are still new in financial terms.

Transactions which include financial assets such as stocks and bonds could eventually be traded using this technology.

How to Mine Cryptocurrency?

Method one : Cloud Mining

Cloud mining is one of the most famous ways of mining cryptocurrency is as it is a process where you pay someone a particular amount of cash and rent out their mining machine which is known as a rig and the mining process itself.

The individuals or the companies which offer these cloud mining services typically have used mining facilities with multiple farms at their disposal and know perfectly well how to mine the cryptocurrency.

Method two : CPU Mining

In CPU mining, processers are used for mining cryptocurrencies. Currently, few and few individuals are selecting this method for mining their cryptocurrency daily.

The reason being that CPU mining is extremely slow and you make very little amount of money using this method.

Method three : GPU Mining

One of the most well known and a famous methods of mining cryptocurrency is GPU mining.

Cloud miners are professionals who sometimes have hundreds if not thousands of GPU rigs.

GPU mining is famous because it is both relatively cheap and efficient.

GPU mining rigs is great when it comes to the general workforce and its hash speed.

Method four: ASIC Mining

Application specific integrated circuits or ASICs special devices which are designed explicitly for performing a single task.

They are treasured and very well known because they produce heavy amount of cryptocurrency as compared to its competitive such as GPU mining and CPU mining.

How to read Cryptocurrency charts?

Step 1 : Time Selection

The cryptocurrency charts let you to select the frame of time you want the candle sticks to cover.

This essentially means that the cryptocurrency candlesticks will show all of the transactions that took place in the selected frame of time.

Step 2 : Volume

The second thing which the standard cryptocurrencies chart will display is the volume and the volume will show you how much trading activity occurred during the time frame that is selected.

Step 3 : Bullish and Bearish Candlesticks

In the third step you need to distinguish between two types of candlesticks –

- Bullish candlesticks

- Bearish candlesticks

The bullish candlesticks all the candlestick which are represented by green candles and that indicates that the price has increased during the time frame which has been selected by you.

On the other hand, for bullish candlesticks, the top of the body represents the closing price while the bottom of the section represents the opening price.

The wicks of the candlesticks represent the lowest prices and highest prices during the selected time frame.

How to start your own cryptocurrency?

There are two main ways of creating your own cryptocurrency –

- Building your own blockchain as this will have its own coin.

- Use of platforms such as Ethereum or NEO for creating an application as this will have its own token.

Tokens and points are both cryptocurrencies but the difference is that token is built on an existing blockchain while a coin belongs to its blockchain.

So there can be only one coin, while there can be thousands of tokens built onto a blockchain.

The tokens created and built on Ethereum are known as ERC-20 token and this is because the blockchain of Ethereum is a great playing field for individuals who are trying to make and create their own cryptocurrency as it was the first to offer this service and this very well placed and trusted in the market.

NEO is the second most popular platform and is very similar as it allows people to use it in blockchain of NEO for creating tokens and application.

Deciding whether you need at token or a coin is a very big choice as it determines many things for your projects at as the amount of cash you will be required to spend.

However you can just create a token if you don’t need your blockchain. This way, you can just build an application that runs on an existing blockchain such as NEO or Ethereum rather than building your blockchain.

Initial Coin Offerings (ICOs)

A company provides an initial public offering when it decide to go public on a Stock Exchange – this is a way for raising funds in exchange for shares.

Well, initial coin offering are very much similar as they are how blockchain-savvy industries and companies try to raise funds for all their cryptocurrency projects.

The Big Idea of creating your own cryptocurrency

You must add value, if you want to create value and therefore you will be required to think about a real problem and how your blockchain technology can solve it.

Some industries that might get your brain slowing with ideas are energy and electricity, medical, finance, marketing, peer-to-peer communication, insurance, content services and file storage.

The Development Team

The primary key factor is the idea, but it is useless and worthless without a good development team.

You should remember that you should only hire individuals who have use of experience working with the technology of blockchain.

You should aim to become more involved in the community of blockchain for making the contact you need.

You should build relationships within the industry by connecting with new people and going to the events of blockchain.

Smart Contracts

A Smart contract is like a traditional contract, except it cannot be changed, is executed automatically, runs on the blockchain and is digital.

Rules are written inside a smart contract, and it operates automatically such that there is no third party controlling it.

You must decide the rules of the smart contract depending on how you want your ICO to work as these are written by your developers.

A Professional External Audit

You need a professional audit show that a user knows that it is secure, as figuring out how to create a cryptocurrency also includes figuring out the safety and security of it.

This also means that you can also feel safe.

This is a vital step that brings legitimacy to your project and these audits are known as security audit from companies such as Practical Assurance.

You should always choose an audit company that has a long history and is credible.

You should also get your ICO verified with the professional audit as it will help promote your project of cryptocurrency.

It promotes the fact that your cryptocurrency project is following data protection policies and industry standards as it adds extra value to your project because it is a crucial step.

Well-Written Whitepaper

You will be required for making a good whitepaper if you want to learn how to create your own cryptocurrency.

This is an essential step because a whitepaper is what investors will use for judging your project.

Awhitepaper will be considered good if it follow the following format –

- All white papers should be in the format of PDF as they can be easily accessed on different browsers and systems without worrying about a structure of format and layout problems.

- All white papers must have 2 versions – a Lite paper which is around 2 to 8 pages and a regular white paper which is around 20 pages to 100 pages.

- Good grammar is a must and your white paper should be in multiple languages. You can hire translators so that you can release your white paper in the most famous languages such as Korean, Japanese, Spanish, Mandarin and English.

Marketing for your ICO

A great part of how to create your own cryptocurrency is creating your marketing strategy for it.

You are required to build trust and support from a local community and for this you will require a good social media presence, a good domain and a good website.

Managing your Community

Your community can be a powerful tool for surrounding yourself with, while learning how to create your own cryptocurrency as you will require a place in which your community can talk to one another and ask you questions.

Why it is better to invest in Bitcoin than property/ businesses/ gold/ forex?

Could any 2 investments seem more different than property/ businesses/ gold/ forex versus digital currencies such as Bitcoin?

Gold and Bitcoin share a great deal in common as the latter was purposefully designed to mimic some of the former’s unique natural properties.

People even ‘mine’ for Bitcoin virtually alike mining physically for gold.

Still, property/ businesses/ gold/ forex and Bitcoin (cryptocurrencies) are very different assets that serve vastly different purposes in the portfolio of an investor.

- Gold – Virtually Indestructible by nature, Counterfeit-Resistant, Divisible, and Limited

- Property – Destructible by nature, Counterfeit-Resistant, Divisible and Limited

- Businesses – Destructible by nature, Counterfeit-Resistant, Divisible and Limited

- Forex – Virtually Indestructible by nature, Counterfeit-Resistant, Divisible, and Limited

No one’s making any more

All the gold and property on Earth is the likely result of billions of years. No one can just will more of it into existence, alike the modern ‘fiat’ currency. No alchemy can create more. Moreover, part of the value of gold is tied to its supply.

Difficult to Counterfeit

Unique properties of the above-mentioned mean that experts of the respective fields have several ways to verify the authenticity.

These things last forever

Gold/ Property/ Businesses/ Forex will last forever unlike you and me.

- Bitcoin – Democratic by Design, Counterfeit-Resistant, Divisible and Limited

In the end, we just have to say that Gold/ Property/ Businesses/ Forex play a vital, unique, and important role in any modern portfolio.

In the same way, Bitcoin and other cryptocurrencies will too work for many investors.

But their roles remain quite different (won’t be wrong if I say complimentary), and crypto-like Bitcoins are here to stay for a long, long time.

The Future of Cryptocurrency

Some of the limitations that cryptocurrency presently face such as a virtual vault may be ransacked by a hacker or the fact that one’s digital fortune can be erased by a computer crash may be overcome in time through technological advances.

What will be harder to surmount – the paradox that bedevils cryptocurrency, the more famous they become, the more government scrutiny and regulation they are likely to attract that erodes the basic premises for their existence.

The number of merchants who accept cryptocurrencies are still in the minority, however they have steadily increased.

They have to first gained widespread acceptance among customers for cryptocurrencies to become the more widely used.

Their relative complexity than conventional currency will likely deter most individuals except for the technological adept people.

A Crypto-currency may have to satisfy widely divergent criteria to become part of the mainstream financial system.

It will required to be mathematically complex but easy to understand for customers.

It will be decentralized but with adequate customer protection and safeguards.

It will preserve the anonymity of a user without other nefarious activities such as money laundering and without being a conduit for tax evasion.

What do we do? How our experts understand the market & do the trades to ensure assured short & long term growth

We can even sell a loser

As you may know that there is no guarantee that a stock will rebound after a decline, and we are realistic about the prospects of poorly-performing investments.

We don’t sweat the small stuff

Rather than panicking over the short-term movements of an investment, we track its big-picture trajectory.

We have confidence in the larger story of an investment and don’t get swayed away by short-term volatility.

We don’t chase a hot tip

Irrespective of the source, we never accept a stock tip as valid. We always do our analysis of an institution before investing your hard-earned money.

We pick a strategy and stick with it

There are several ways for picking stocks, and it’s imperative to stick with a single philosophy.

We don’t overemphasize the P/E Ratio

We don’t place too much emphasis on a single metric. We believe that the P/E Ratio is best used in conjunction with any other analytical process.

We keep a long-term perspective and focus on the future

Our investing depends on making informed decisions based on things that are about to happen.

As you may know, that past information can indicate things to happen, but it’s never guaranteed.

We are open-minded

If yours is a smaller business, then also it has the potential of becoming the blue-chip names of tomorrow. We believe it and take steps to make it happen.

We are concerned about taxes, so you don’t need to worry

We strive to minimize tax liability as accomplishing high returns is our main goal.